Car insurance in New York is not just a legal necessity – it’s essential for protecting your finances and safety on the road. With hundreds of insurers available, New York drivers have plenty of options, from big national companies to smaller regional providers. Choosing the best car insurance means finding a policy that meets state requirements and provides the right coverage at an affordable price, all while offering reliable service when you need to file a claim. In this article, we’ll give an overview of New York’s car insurance requirements, compare top-rated insurance providers (including GEICO, State Farm, Progressive, Allstate, and New York Central Mutual), and highlight key factors like pricing, coverage types, customer service, claims handling, financial strength, and discounts. We’ll also discuss local considerations – such as New York’s no-fault insurance law, minimum coverage limits, and how insurance rates in New York City differ from upstate – and recommend top providers for various needs (budget-conscious drivers, high-risk drivers, new car owners, etc.).

Whether you’re a new driver in the Empire State or just looking to save on your premiums, this guide will help you navigate the best car insurance in New York in an informative, neutral tone. Let’s dive in.

New York Car Insurance Requirements

New York State has specific minimum insurance requirements that all drivers must carry. Liability insurance is mandatory to cover injuries or damages you might cause to others in an accident. The minimum liability limits in New York are 25/50/10, meaning at least $25,000 in bodily injury coverage per person, $50,000 per accident, and $10,000 for property damage. In other words, if you’re at fault in an accident, your insurance must be able to pay at least $25,000 for injuries to one person (up to $50,000 if a person is killed), up to $50,000 total for all injuries per accident (or $100,000 for fatalities), and $10,000 for damage to others’ property.

New York is also a no-fault insurance state, which means every driver’s own insurance covers their personal injury protection (PIP) benefits, regardless of who caused the accident. New York requires a minimum of $50,000 in PIP coverage per person (often called “basic no-fault” coverage) to pay for your medical expenses, lost wages, and other reasonable costs if you or your passengers are injured. PIP coverage ensures that if you’re injured, you can get compensation for economic losses quickly, without having to wait and determine who was at fault. However, it does not cover vehicle damage – that’s where liability (for others’ cars) or collision coverage (for your car) comes in. Additionally, New York mandates uninsured motorist (UM) coverage for bodily injury. This means your policy must protect you and your passengers if you’re injured by a hit-and-run driver or someone who doesn’t have insurance. The required minimum UM coverage in NY is the same 25/50 bodily injury limits as liability. (Underinsured motorist coverage, which protects you if an at-fault driver’s insurance is insufficient, is not required but can be added for extra protection.)

It’s important to note that these are just minimum requirements. Carrying only the minimum 25/50/10 liability coverage may not be enough in a serious accident – medical bills and lawsuits can easily exceed those limits. Many New York drivers opt for higher liability limits (such as 50/100/50 or more) to better protect their assets. If you have a car loan or lease, your lender will also require you to carry collision and comprehensive coverage (known as “full coverage”) to cover damage to your own vehicle. Collision pays for repairs to your car after an accident, and comprehensive covers non-collision losses like theft, vandalism, fire, or storm damage. While collision and comprehensive are not required by New York law, they are highly recommended for most drivers, especially if your car is relatively new or valuable.

New York’s No-Fault Law and Local Considerations

New York’s status as a no-fault insurance state influences how claims are handled and partially explains the cost of insurance in the state. Under no-fault, if you’re in an accident, your own PIP coverage pays for your medical bills (up to the limit) regardless of who was at fault. You generally cannot sue the other driver for pain-and-suffering or other non-economic damages unless your injuries exceed certain “serious injury” thresholds defined by law (e.g. significant disfigurement, broken bones, permanent disability, or medical expenses above $50,000). This system is intended to reduce lawsuits and ensure prompt payment of medical claims. However, it can also lead to higher insurance premiums because insurers must cover many minor injury claims (and New York’s no-fault system has historically had issues with insurance fraud and inflated medical claims, which drive costs up for everyone).

When buying car insurance in New York, it’s crucial to consider local factors that affect rates and coverage needs. For instance, where in New York you live will have a big impact on your premium. Urban areas, especially New York City, tend to have much higher insurance rates than rural or upstate areas. The higher population density and traffic congestion in NYC means a greater risk of accidents, plus more incidents of theft or vandalism, which all contribute to pricier insurance. According to industry data, the average annual premium for a full coverage policy in Buffalo (western New York) is about $1,617 – whereas in New York City it’s roughly $3,060, nearly double. In fact, NYC drivers often pay 50-60% more than the state average, while smaller cities like Rochester or Syracuse enjoy much lower rates. For example, Buffalo’s typical premium is 15% below the state average, while NYC’s is about 60% above average. This dramatic difference means a driver in Manhattan might pay thousands more per year for the same coverage than a driver in upstate New York.

Even within the NYC metro area, rates can vary by borough and neighborhood. Insurers factor in local crime rates and claim histories by ZIP code. As one analysis highlighted, a driver in Manhattan’s Upper East Side might pay around $279 per month for full coverage, whereas a driver in a higher-crime Brooklyn neighborhood could pay $562 per month – almost double – for a similar policy. While you can’t easily change where you live, it’s good to be aware of these cost drivers and shop around accordingly.

Beyond geography, other local considerations include weather and climate. New York experiences everything from harsh winter storms (snow, ice) upstate to the occasional hurricane or flooding downstate. Severe weather can lead to more claims (e.g. collisions on icy roads, flood or hail damage), which in turn can push premiums higher. For instance, insurance experts note that states prone to extreme weather tend to have higher auto insurance rates – and New York, with its winter blizzards and even hurricanes (like Superstorm Sandy), is no exception. Comprehensive coverage is particularly important in New York for this reason, as it can cover weather-related damage to your car.

New York also has a system in place for high-risk drivers who have trouble obtaining insurance from regular companies. If you have a very poor driving record (multiple accidents or serious violations) and standard insurers decline to cover you, you can get coverage through the New York Automobile Insurance Plan (NYAIP), which is essentially an assigned-risk pool. NYAIP will assign you to an insurance company, but be prepared – rates under this plan are usually much higher than the voluntary market. It’s usually a last resort for drivers who can’t find coverage elsewhere. Improving your driving record over time can get you back into standard coverage with more affordable rates.

Factors to Consider When Choosing Car Insurance

Choosing the best car insurance in New York isn’t just about picking the cheapest policy. You’ll want to consider a range of factors to make sure the insurer and coverage you select are the right fit. Here are some important factors to keep in mind:

Price and Premiums: Cost is a major consideration for most people. Insurance premiums in New York are higher than the national average – nearly 94% higher for full coverage, according to one analysis. Within the state, premiums can range widely. For example, a 40-year-old driver with a clean record might get quotes as low as ~$85 per month (with a company like Progressive) or as high as $223 per month (with a company like Travelers) for the same coverage. That’s a difference of over $1,600 per year for a similar policy! It pays to shop around and compare rates. When evaluating price, make sure you’re comparing apples to apples – same coverage levels and deductibles. The cheapest policy might only provide minimum coverage, which could leave you under-protected. Balance cost with the coverage you need. Also consider that some insurers offer payment plans, paid-in-full discounts, or different rate options (monthly vs. semiannual payments), which can affect affordability.

Coverage Options: Look at what types of coverage each insurer offers and any additional options or endorsements. All companies will offer the basics (liability, collision, comprehensive, PIP, uninsured/underinsured motorist). But some insurers have valuable add-ons: for example, new car replacement coverage (which can replace your vehicle with a brand-new one if it’s totaled in the first year or two), accident forgiveness (waives your first at-fault accident so your rates don’t jump), gap insurance (covers the loan payoff if your car is totaled and you owe more than its value), or roadside assistance programs. If you drive for Uber/Lyft, you may need a rideshare endorsement (offered by insurers like GEICO, State Farm, and USAA) to stay covered while working. Think about your personal needs – do you want rental car reimbursement if your car’s in the shop? Custom equipment coverage for after-market upgrades? Each insurer’s offerings can differ. For instance, Progressive offers a “Snapshot” usage-based program for potential discounts, while Allstate offers deductible rewards and safe-driving bonus checks. Make sure the insurer you choose has the coverage types and extras that matter to you.

Customer Service and Reviews: Not all insurance companies are equal when it comes to customer satisfaction. You want an insurer that is known for treating customers well – answering questions promptly, helping you understand your policy, and being there for you in an emergency. One way to gauge this is through customer satisfaction ratings like the J.D. Power Auto Insurance Study. In the most recent J.D. Power survey for the New York region, for example, State Farm and NYCM Insurance scored above average for customer satisfaction, while some others were around the industry average. It’s also worth checking consumer reviews and complaint records. The New York Department of Financial Services publishes complaint ratios for insurers doing business in NY, and a lower complaint ratio means fewer unhappy customers relative to the company’s size. Regional or smaller insurers (like NYCM or Erie Insurance) sometimes outperform the big names in customer satisfaction because they may offer more personalized service. Consider how you prefer to interact with your insurer as well – do you value having a local agent you can visit or call directly (as you would with State Farm, Allstate, or NYCM’s agents), or do you prefer the convenience of a mobile app/website for most transactions (GEICO, Progressive, etc. excel in online service)?

Claims Handling: The true test of an insurance company is how it handles claims. Fast and fair claims processing is crucial, especially if you ever have an accident. Research how each insurer ranks in claims satisfaction – J.D. Power also conducts a claims satisfaction study. You can also look at anecdotes: Does the company have a reputation for paying out claims without hassle, or do they often look for ways to deny or delay? A company like USAA (for those eligible) is frequently lauded for excellent claims service, and others like Amica and State Farm also tend to get good marks for claims handling. Check if an insurer offers a streamlined claims process, such as 24/7 claims reporting, online claim status tracking, or even concierge services that handle car repairs for you. The easier the claims process, the less stress you’ll have after an accident. Financial strength (discussed next) also plays a role in claims – you want to be confident the company can pay what it owes.

Financial Strength: An insurance policy is a promise, so you want the insurer to be financially sound and able to pay claims, even in catastrophic situations. Independent ratings agencies like A.M. Best, Standard & Poor’s, and Moody’s rate insurance companies on their financial stability. A.M. Best’s ratings are commonly used in the insurance industry – for example, State Farm and GEICO carry A.M. Best’s highest rating of A++ (Superior), indicating excellent ability to meet their obligations. Allstate and Progressive also have strong A+ ratings, while a regional company like NYCM has a solid A (Excellent) rating. In practice, this means all of the top insurers in New York are financially dependable. However, it’s still wise to be aware – if you come across a very small or lesser-known insurer offering a tempting low rate, take a moment to verify their financial rating and longevity. You don’t want to be stuck with unpaid claims because an insurer becomes insolvent or can’t cover a large accident.

Discounts and Cost-Saving Programs: Finally, always consider the discounts each insurance provider offers, as these can make a big difference in your premium. Common discounts include safe driver discounts (no accidents or violations), multi-policy discounts (bundling your auto with home or renters insurance with the same company), multi-car discounts (insuring multiple vehicles on one policy), good student discounts (for student drivers with a B average or better), student away from home discounts, driver training discounts, vehicle safety features (airbags, anti-theft devices), and more. For example, GEICO is well-known for its long list of discounts – ranging from federal employee and military discounts to discounts for defensive driving courses. State Farm offers a notable Steer Clear program for young drivers and a Drive Safe & Save usage-based discount program. Progressive’s Snapshot program can reward you for good driving habits by tracking your driving. Many New York insurers also give a discount for paperless billing or signing up for automatic payments. When comparing quotes, ask about all available discounts – sometimes an insurer with a higher base rate might become the cheapest option after applying applicable discounts. Additionally, consider deductibles and coverage limits as levers to adjust your premium: a higher deductible (what you pay out of pocket in a claim) will lower your premium, but make sure it’s an amount you could afford to pay if an accident happens.

In summary, the best car insurance for you will depend on how these factors align with your personal situation. Next, we’ll look at some of the top car insurance providers in New York and see how they stack up on these criteria.

Top Car Insurance Providers in New York

New York drivers can choose from many insurance companies, but a few stand out as the most popular and top-rated in the state. Below, we provide an overview of some of the best car insurance providers in New York, including major national companies and a notable New York-based insurer. We’ll compare their pricing, coverage offerings, customer service reputation, claims handling, financial strength, and discounts. (All of the companies listed operate statewide – whether you’re in NYC, Long Island, Buffalo, or anywhere in between, these insurers can provide coverage.)

GEICO

GEICO (Government Employees Insurance Company) is one of the largest auto insurers in New York and the nation. It’s often synonymous with affordable rates, thanks to its extensive use of online direct-to-consumer sales which can reduce overhead costs. GEICO is well known for competitive pricing, frequently offering some of the lowest quotes for many drivers – especially those with good driving records. In fact, GEICO’s rates in New York tend to be among the cheapest for minimum coverage, and quite competitive for full coverage as well (one analysis found GEICO’s average full-coverage premium for a 40-year-old driver in NY to be about $1,736 per year, which is cheaper than most other big insurers except Progressive and NYCM).

When it comes to coverage, GEICO provides all the standard options and then some. You can get liability, collision, comprehensive, PIP, UM/UIM, and also add-ons like rental car reimbursement, roadside assistance, and mechanical breakdown insurance (MBI). MBI is a unique feature that acts similar to an extended warranty for newer cars – it’s one way GEICO appeals to drivers with new or slightly used vehicles. GEICO does not have local agent offices in most of New York (aside from a few local sales offices); instead, customers manage their policy and claims online or via GEICO’s highly rated mobile app. For many tech-savvy drivers, this 24/7 online convenience is a big plus. GEICO’s customer service is generally rated above average. While GEICO historically scored a bit below State Farm in J.D. Power satisfaction studies, it still performs well, and its claims satisfaction is solid. The company’s massive customer base indicates that it keeps most drivers reasonably happy, and it has one of the lower complaint ratios in New York for an insurer of its size.

Financial strength is a non-issue with GEICO – it’s a subsidiary of Berkshire Hathaway and carries an A++ A.M. Best rating (Superior), meaning it’s extremely financially secure. GEICO also shines in the area of discounts. They offer a long list of discounts, including: multi-policy (if you also get renters/home insurance through GEICO’s partners), multi-vehicle, good driver, good student, seatbelt use, defensive driving course discounts (important in NY – completing a state-approved defensive driving course can cut 10% off certain coverages), military and federal employee discounts, and even affinity discounts for members of certain alumni associations or groups. GEICO’s approach is largely “no-frills” – you won’t necessarily get a personal agent, but you will likely save money. This makes GEICO an excellent choice for budget-conscious drivers who prioritize low premiums and easy service. Just be prepared to handle most of your interactions online or by phone.

State Farm

State Farm is the largest auto insurance company in the United States by market share, and it has a very strong presence in New York. State Farm is often known for its slogan “like a good neighbor, State Farm is there,” emphasizing its network of local agents and personalized service. In New York, State Farm’s rates are typically middle-of-the-road – not always the cheapest, but often competitive when you factor in its numerous discounts and the value of having an agent. For a full coverage policy, State Farm’s average premium for a 40-year-old New York driver is around $1,951 per year (about $163 per month). This is higher than GEICO or Progressive’s averages, but State Farm policyholders often stay for the service and one-stop convenience of bundling multiple policies. If you have your homeowners or renters insurance with State Farm, the multi-line discount can make a big dent in that premium.

In terms of coverage options, State Farm offers all the standard coverages required in NY (liability, PIP, etc.) and popular add-ons like roadside assistance and rental car coverage. They don’t advertise flashy extras as much as some competitors, but they do have a few notable programs. One is Drive Safe & Save, a telematics program where you can get a discount by using a mobile app or device that tracks your driving behavior (safe drivers can save up to 30%). Another is Steer Clear, a program aimed at drivers under 25 to help improve their driving skills and earn a discount upon completion (great for young drivers, who typically face very high rates in NY). State Farm also offers rideshare insurance add-ons in NY for those driving for Uber or Lyft.

Customer service is a strong point for State Farm. In the New York region J.D. Power satisfaction survey, State Farm consistently ranks near the top for auto insurance satisfaction. Many customers appreciate having a dedicated agent – someone you can call directly, whether you have a billing question or need help with a claim. During claims, State Farm is known for being reliable and fair; they also have a large network of approved repair shops and a generally smooth claims process.

Financial strength is excellent (State Farm has an A++ from A.M. Best, reflecting its ability to pay claims). Discounts available through State Farm include multi-policy, multi-car, safe driver, good student, driver training, student away at school, and an accident-free discount for long-term customers with no claims. They don’t have as many niche discounts as GEICO, but the main ones are there. State Farm may be the best choice for drivers who value personalized service and agent support, such as families or individuals with multiple insurance needs (auto, home, life) who like the idea of everything handled by one local agent. It’s also a top pick for young drivers in New York who can take advantage of State Farm’s youth-oriented programs and discounts to counteract high premiums.

Progressive

Progressive is another large national insurer that is very popular in New York. Progressive often markets itself on competitive pricing and innovation. It’s the company with the well-known TV commercials (Flo, etc.) and has a strong online presence similar to GEICO. In New York, Progressive tends to be extremely competitive on price, especially for drivers who might not have perfect records. In fact, Progressive currently offers the lowest average rates in New York for many driver profiles. One recent study found Progressive’s average full coverage premium for a New York driver to be about $1,020 per year (just $85 per month) – the cheapest among major companies. Progressive was even lower than the regional NYCM in that comparison, which is impressive. This makes Progressive a go-to option for budget-conscious drivers and particularly for those who’ve had an accident or ticket; Progressive is known for often being more forgiving (or at least not as prohibitively expensive) for “high-risk” drivers compared to some competitors.

Progressive offers a full suite of coverage options. Aside from the standard coverages, Progressive is known for extras like accident forgiveness (small accident forgiveness for claims under $500, and a larger accident forgiveness feature if you’ve been claim-free for a certain time). They also include pet injury coverage automatically if you have collision coverage – so if your dog or cat is injured in a car accident, vet bills can be covered up to a certain amount. Progressive’s Snapshot program is a notable feature: by enrolling and allowing Progressive to track your driving habits (either via a plug-in device or a mobile app), safe drivers can earn significant discounts. Snapshot can be great for New Yorkers who drive infrequently or carefully – for example, a Brooklyn or Queens driver who only uses their car on weekends might save a lot. Progressive also has a handy Name Your Price tool on their website, which helps tailor coverage to fit a budget, though you should be careful to not skimp on essential coverage just to hit a price.

In terms of customer service, Progressive has a bit of a mixed reputation. It performs around average in customer satisfaction studies. Many customers like the seamless online experience and 24/7 support. Progressive’s mobile app and website allow you to do almost everything (buy a policy, file a claim, etc.) without speaking to an agent. They also have a unique concierge claims service in some areas – you drop your car at a Progressive Service Center and they handle the repairs, rental car, etc., and then return your fixed car to you. This kind of service can simplify the claims process. On the other hand, some reviews indicate that Progressive’s rates can increase more than expected after an accident (if you don’t have accident forgiveness), and some customers have reported less personalized attention, which is expected since Progressive relies mostly on direct sales.

Financially, Progressive is strong (A.M. Best rating of A+). It’s a Fortune 100 company, so no worries there. Discounts with Progressive include multi-policy (they advertise bundling auto with homeowners or renters – Progressive partners with third-party home insurers for bundling), multi-car, continuous insurance (discount for not having lapses in coverage), teen driver discounts, student discounts, homeowner (even if your home policy is with another company, they may give an auto discount for being a homeowner), online quote discount, paperless, paid-in-full, and of course the Snapshot usage-based discounts. Progressive also often has a small discount if you sign your documents online when purchasing a policy. All in all, Progressive is a top pick in New York for those who want low rates and are comfortable managing their insurance digitally. It’s especially a strong option for high-risk drivers (e.g., those with accidents, violations, or DUIs on record) since Progressive’s underwriting tends to be more accommodating in that market – they started out insuring high-risk drivers and still specialize in it.

Allstate

Allstate is another major insurer serving New York, recognizable by its slogan “You’re in good hands with Allstate.” Allstate, like State Farm, operates on an agent-based model, meaning you get a local Allstate agent to help with policy service and claims guidance. Allstate’s prices in New York are generally moderate to slightly above average. In a comparison of rates, Allstate’s full coverage premium for a sample driver was about $2,056 per year (around $171 per month), placing it on the higher side among the top insurers (a bit more expensive than State Farm, and definitely more than GEICO/Progressive). However, Allstate offers a lot of features and can be cost-effective for certain drivers once discounts are applied.

One area where Allstate stands out is its array of coverage options and add-ons. Allstate offers several unique optional coverages: new car replacement (if your new car is totaled within the first two model years, they’ll pay to replace it with a brand-new car, not just the depreciated value), accident forgiveness (protects your rates from going up after one at-fault accident), vanishing deductibles (called Deductible Rewards – your collision deductible goes down each year you drive claim-free, up to $500 total reduction), and ride-hailing insurance for Uber/Lyft drivers. They also have a program called Allstate Rewards where you can earn points (through their mobile app for safe driving or even policy activities) to redeem for gift cards or merchandise – a perk that adds a bit of fun to safe driving. Of course, Allstate provides the required liability and PIP coverage, along with collision and comprehensive. If you have a new or high-value car, Allstate’s new car replacement or gap insurance could be very appealing.

Customer service for Allstate is generally good, thanks to their agent network. In customer satisfaction studies, Allstate usually ranks around average. Its J.D. Power score for the New York region is in line with the industry average. Many New Yorkers choose Allstate because they want an agent but perhaps got a slightly better quote than State Farm or prefer Allstate’s specific discounts. Allstate’s claims process is well-established – they offer 24/7 claims reporting and have drive-in centers in some areas for inspections. They also heavily promote their Claim Satisfaction Guarantee (if you’re not happy with how a claim was handled, they may give you a credit on your premium).

Allstate is financially strong (A+ by A.M. Best). When it comes to discounts, Allstate has quite a few: multi-policy (they encourage bundling home/auto), multi-car, safe driver, anti-theft device, anti-lock brakes, early signing (if you sign up for a policy well before your current one expires), autopay, paperless, good student, student away at school, and new car discount. They also have a telematics program called Drivewise – you can use the Drivewise app to earn discounts for safe driving habits (even non-customers can use the app to get some rewards, but policyholders get actual discount credits up to perhaps 10%). Considering these, Allstate can be a good fit for drivers who appreciate local agent support and want premium coverage options like accident forgiveness or new car replacement. If you have a clean driving record and bundle policies, Allstate may reward you with competitive rates. It might not be the very cheapest for everyone, but you do “get what you pay for” in terms of service and coverage features.

New York Central Mutual (NYCM) Insurance

New York Central Mutual, commonly known as NYCM Insurance, is a regional insurer that is based in New York State (headquartered in Edmeston, NY). As a local company, NYCM has been serving New Yorkers for over 100 years and often gets high marks for customer satisfaction in the state. While smaller than the nationwide brands, NYCM is often included in “best of New York” insurance lists because it combines strong service with competitive rates for many drivers. In fact, NYCM was ranked as the best auto insurance company in New York in a 2024 Insure.com analysis that considered factors like cost, J.D. Power scores, financial strength, and complaint ratios. One reason is their pricing: NYCM tends to offer lower-than-average premiums for many New York drivers. For example, NYCM’s average premium for full coverage in NY (for that same 40-year-old driver profile) was about $1,300 per year, considerably cheaper than most big-name insurers. That puts it only slightly higher than Progressive’s rock-bottom rate, and well below State Farm, Allstate, and others. Many customers report that NYCM often beats the likes of GEICO on price in upstate New York regions, especially for those with clean records.

NYCM offers standard coverage options including liability, PIP, UM/UIM, collision, and comprehensive. They also offer typical add-ons such as roadside assistance and rental car coverage. Because NYCM is a regional carrier, they may not have as many flashy programs as some national companies, but they cover the basics well. One thing to note is that NYCM sells insurance through a network of independent agents across New York. So when you get a quote or policy with NYCM, you’re likely dealing with a local independent insurance agent (who may also be able to offer quotes from other companies). Many customers like this personalized touch and the ability to have a face-to-face conversation about their policy. NYCM’s size allows it to be attuned to New York-specific needs – for instance, they are very experienced with no-fault (PIP) claims in NY and navigating state regulations.

Customer service is where NYCM really shines. In the J.D. Power 2024 customer satisfaction survey for New York/New England, NYCM scored 842 out of 1000, which is above the regional average and on par with or better than many larger insurers. NYCM also typically has a very low complaint index (meaning few complaints relative to its size) according to the NY State Department of Financial Services. Policyholders often praise NYCM’s handling of claims – adjusters and agents who are responsive and fair. Being a smaller company, there’s a sense that NYCM can provide more individualized attention. For drivers who value being treated like a person, not a number, NYCM is appealing.

On financial strength, NYCM is rated A (Excellent) by A.M. Best, which, while a notch below the giants, is still a strong rating indicating a healthy ability to pay claims. The company has been around since 1899, so it has longevity. As for discounts, NYCM offers many of the typical ones: multi-policy (they also offer home and umbrella insurance, so bundling can save money), multi-vehicle, safe driver, defensive driving course discount, good student, student away from home, anti-theft, etc. Because they sell through agents, sometimes agents can help find additional niche discounts you might qualify for. NYCM may not advertise on national TV or have a flashy app (though they do have a functional online portal), but if you prefer a regional insurer with a strong reputation in NY, they are a top contender. NYCM is often recommended for drivers who prioritize customer service and local expertise, as well as those who simply want a low premium from a reliable company.

(Other Notable Insurers: Aside from the above, New York drivers have other good options. USAA consistently gets some of the highest customer satisfaction scores and very competitive rates, but it is only available to military members, veterans, and their families. If you qualify, USAA is absolutely worth considering – their service and claims handling are top-notch, and they often have the lowest rates for those who are eligible. Erie Insurance is another regional company (based in PA) that operates in parts of New York; Erie often offers great rates and has a loyal customer base, though they aren’t statewide (mostly upstate and western NY). Travelers, Nationwide, Liberty Mutual, and Farmers are other national companies writing auto policies in New York – each with their own strengths. Travelers, for instance, is known for good coverage options and bundling discounts (big in the Northeast), but as noted earlier, their rates in NY can be on the high side for some profiles. It’s wise to get quotes from a mix of insurers – big and small – to see who offers the best combination of price and coverage for your situation.)*

Comparison of Top New York Car Insurance Companies

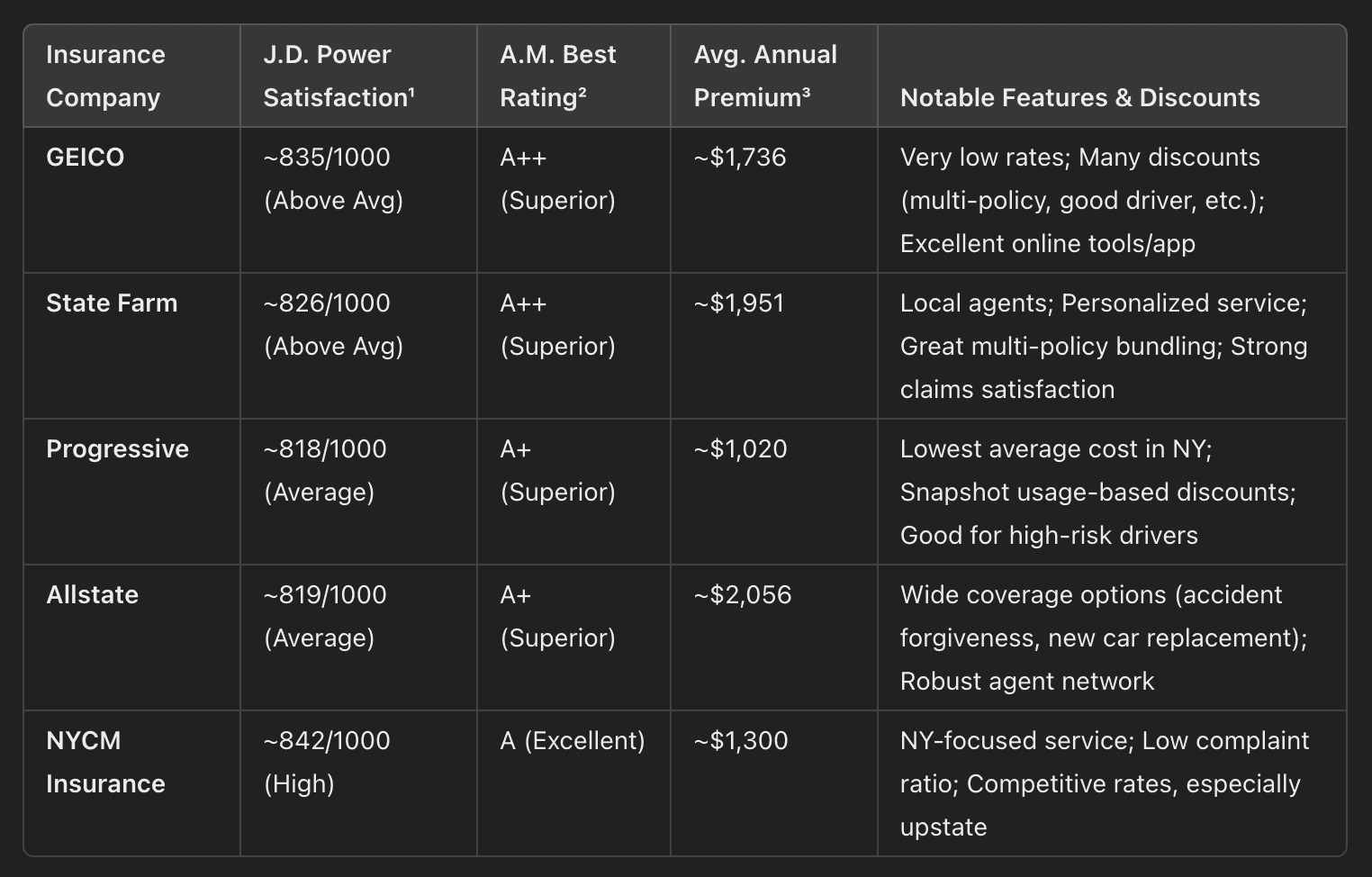

For a quick overview, the table below compares some key features of major car insurance providers in New York. This includes their customer satisfaction ratings, financial strength, an example average annual premium, and a highlight of notable features or advantages for each insurer. (The example premiums shown are approximate averages for a 40-year-old driver with a clean record and full coverage in NY, used here for relative comparison. Your actual quotes will vary.)

Best Car Insurance for Different Driver Needs

Every driver’s situation is unique. The “best” insurance for one person might not be the best for another. Here we highlight some top provider recommendations tailored to specific types of drivers or priorities. Whether you’re trying to save money, have a less-than-perfect record, or just bought a new car, these suggestions point you toward insurers that excel in those areas.

Best for Budget-Conscious Drivers (Finding the Cheapest Rates)

If saving money is your top priority, you’ll want an insurer known for low rates in New York. Based on rate comparisons, Progressive and NYCM Insurance consistently offer some of the cheapest car insurance in New York for a variety of driver profiles. Progressive had the absolute lowest average rate in a recent survey (around $1,020/year for full coverage), and NYCM was not far behind at $1,300/year. GEICO is another excellent choice for budget-conscious drivers – while not always the very lowest, GEICO’s rates are usually among the most affordable statewide, especially for minimum coverage or if you qualify for several of their discounts. It’s common for New Yorkers shopping on price to find GEICO or Progressive at the top of their quote comparisons.

To get the best deal, take advantage of discounts: for example, if you’re a safe driver with no accidents, make sure to get a quote from GEICO, which heavily rewards clean records. If you’re insuring multiple cars or also need renters insurance, consider State Farm or Allstate for bundling deals – sometimes the bundle discount can tip the scales. Also, consider using a local independent agent who can quote NYCM and other regional carriers; sometimes these smaller insurers don’t show up on big comparison websites but can save you money. Remember that the cheapest policy isn’t just about the sticker price – ensure it still meets your coverage needs. But for pure budget-friendliness, start with Progressive, GEICO, and NYCM in New York, and always compare at least 3-4 quotes. Many drivers are surprised at how much rates can differ for the same person across companies (as shown by the range from $1k to $2.7k in the earlier example). With a bit of shopping around, you’re likely to find a policy that fits your budget.

Best for High-Risk Drivers (Tickets, Accidents, or DUIs)

If you have a less-than-perfect driving history – say an at-fault accident, a couple of speeding tickets, or a DUI – finding affordable insurance in New York can be challenging. High-risk drivers face significantly higher premiums, but some companies are more forgiving or specialized in this market. Progressive is often cited as one of the best options for high-risk drivers. Progressive started its business catering to high-risk individuals and to this day tends to offer comparatively better rates for those with accidents or violations. They might not jack up the price as steeply as other insurers after a ticket or two. GEICO can also be relatively lenient on certain violations, though it depends on the infraction (a DUI will still cause a big hike with any insurer).

Another strategy for high-risk drivers is to check with statewide or specialized insurers. For instance, The General or National General are companies known for insuring higher-risk drivers (though their rates in NY might or might not be competitive – it’s worth checking). NYCM Insurance may be an option if your record is marginal rather than severe; they might insure you if you have one accident, especially through an agent who can advocate for you. If your record includes a DUI or multiple serious incidents, and standard insurers won’t cover you at all, New York’s assigned risk plan (NYAIP) ensures you can still get insurance – but again, that’s a pricey last resort.

To improve your situation, take a defensive driving course (New York’s Point & Insurance Reduction Program): it can subtract points from your license and give you a 10% liability/PIP premium discount, which helps offset increases. Also, consider opting for telemetry programs like Progressive’s Snapshot or Allstate’s Drivewise. These can demonstrate your current safe driving and possibly override some of your past record in the eyes of the insurer when calculating rates. Over time, focus on keeping your driving clean; as violations age (3+ years old) or accidents fall off, you’ll have more options and lower rates. But in the interim, Progressive is often the go-to for high-risk New York drivers seeking the best price, with GEICO and perhaps Allstate (which has a forgiveness program) worth checking as well.

Best for New Car Owners (Protecting a New or High-Value Car)

If you just bought a new car (or have a fairly new, expensive vehicle), you’ll likely want more than just the state minimum coverage. You’ll want solid collision and comprehensive coverage, and perhaps special add-ons to protect the value of your car. One recommendation for new car owners is Allstate, due to its New Car Replacement option. Allstate will replace your totaled new car with a brand-new vehicle of the same make/model (minus deductible) if the loss occurs within the first two model years or 24,000 miles. That can give tremendous peace of mind in the early years when depreciation could otherwise short-change you. Allstate’s gap insurance (called Loan/Lease Gap Coverage) can also cover the difference if you owe more on a car loan than the car’s worth – useful for new cars that depreciate quickly.

Liberty Mutual is another company to look at for new cars – they offer a similar New Car Replacement for the first year, and even a Better Car Replacement (they’ll pay for a car one model year newer with 15,000 fewer miles than your totaled car). If you’re sticking to the companies on our top list, Allstate and State Farm both offer solid coverage for new cars. State Farm doesn’t have new car replacement, but they do offer gap coverage (Payoff Protector) if you finance through State Farm Bank, and their collision/comprehensive coverage is reliable. GEICO doesn’t have new car replacement per se, but if you combine GEICO’s low rates with maybe purchasing gap coverage from your dealership or lender, that could work too.

For high-end luxury cars or sports cars, you might consider carriers like Chubb or PURE, which specialize in high-value vehicles – though these are more for affluent customers and can be quite pricey, they offer agreed value coverage and top-notch claims service for luxury cars.

New car owners should also look at claims service reputation. If your brand-new car gets dinged or needs repairs, you want an insurer that is quick and uses quality repair shops/parts. USAA (if eligible) and Amica are excellent in claims and could be considered as well. On the discount side, make sure to get the new car discount (most insurers offer a discount if your car is a recent model year) and equip anti-theft devices (which not only protect your car but also usually qualify for discounts). In summary, Allstate is a top pick for new car owners due to its coverage options catering to new vehicles, while State Farm and Liberty Mutual are strong contenders too. Don’t forget to carry higher liability limits on that new ride – if you’re driving a new car, you likely want to protect it and yourself fully, even if it costs a bit more.

Best for Military Families or Veterans

For military members, veterans, and their immediate families, USAA is often the undisputed best choice for car insurance (in New York and across the country). USAA restricts membership to those with military affiliation, but if you’re eligible, you gain access to extremely competitive rates and top-rated customer service. USAA frequently comes out #1 in customer satisfaction surveys nationwide for auto insurance. In New York, USAA isn’t included in the public J.D. Power rankings (because not everyone can choose it), but if it were, it would likely score at or near the top. USAA’s rates for full coverage in New York are usually among the lowest for those who qualify – often beating even GEICO’s prices. Additionally, USAA offers unique benefits for military personnel, such as lenient policies if you have to store your car during deployment, and discounts for garaging your car on base. They also offer a discount for vehicle storage (important for deployed service members who might not use the car for months).

Coverage-wise, USAA provides all standard coverages and excellent claims service. They don’t have a huge roster of gimmicky add-ons; instead, they focus on solid coverage and customer care. Financially, USAA is rock solid (A++ rating). If you or a family member have served in the U.S. military, getting a quote from USAA is a must – it could save you a significant amount. Many military families in New York stick with USAA for life due to their consistent support and low rates.

If you’re not eligible for USAA but are military (perhaps a more distant relation, or you’re a civilian military employee), GEICO might be a good alternative because GEICO originally started for military/government employees and still offers a military discount. Also, Navy Federal Credit Union has a partnership with GEICO that could yield discounts for members. But overall, for those who can get it, USAA is the top recommendation for military members/veterans in New York.

(If you’re a driver with other specific needs – such as a teen driver in the household, a senior citizen, or someone with a specialty vehicle – you may consider tailored options. For teens, look for companies with strong student discounts (State Farm, Nationwide) and safe driving programs. For seniors, some insurers like The Hartford/AARP have programs geared for older drivers. The good news is the major insurers we’ve discussed generally serve all these groups well, with just slight differences in discounts or programs.)

Conclusion

Finding the best car insurance in New York requires balancing state requirements, personal coverage needs, and budget considerations. First and foremost, make sure you meet New York’s minimum insurance laws (25/50/10 liability, $50k PIP, etc.) – driving without insurance in NY can result in severe penalties, including fines and license suspension. But beyond the legal minimums, think about your own protection: if you’re in the bustling traffic of NYC or commuting on the Thruway upstate, adequate coverage will give you peace of mind.

New York’s no-fault system means every driver should have robust PIP coverage and understand that minor injuries will be handled by your own policy. Meanwhile, high accident costs in urban areas mean considering higher liability limits is wise, especially if you drive in New York City’s dense environment. Don’t forget to factor in the local nuances – for instance, comprehensive coverage might be more valuable if you live in an area with high car theft rates or harsh weather.

We compared top insurers like GEICO, State Farm, Progressive, Allstate, and NYCM, and found that each has its strengths. GEICO and Progressive often compete for the lowest premiums (great for saving money), State Farm and Allstate provide strong agent support and full coverage options, and NYCM delivers exceptional local service and satisfaction for New Yorkers. The best provider for you depends on what you prioritize: cost, coverage features, service, or some combination. Our recommendations by category show that, for example, Progressive or GEICO could be best for budget hunters, while Allstate might shine for new car owners, and USAA is unparalleled for those in the military community.

As you shop for car insurance, it’s a good practice to get quotes from multiple companies. Quotes are free, and you might be surprised by which company offers the best deal for your unique profile. Use the information in this guide to ask the right questions: Does the policy cover what I need? Am I getting all the discounts I’m eligible for? How are this company’s reviews and claims ratings? By doing a bit of homework, New York drivers can secure an auto insurance policy that not only checks the legal boxes but also provides excellent protection and value.

Ultimately, the “best” car insurance in New York is one that keeps you well-covered and confident every time you hit the road – whether you’re navigating the busy streets of NYC or the open highways upstate. With the right policy in place, you’ll indeed be “in good hands” (whether it’s Allstate or another insurer!) and can drive with peace of mind knowing you’re protected. Safe driving!